The

percentage of Credit Sales method is used to to estimate the amount of bad debts. For example, a company might believe that 5% of is net credit receivables won't be collected. So, if $500,000 is in a companies net credit receivables then the following entry will take place:

Uncollectible Accounts Expense $25,000

Allowance for Uncollectible Accounts $25,000

CMA MethodRegarding your second question. These transactions take place during the period. Let's say a customer (John Smith) doesn't pay his bill of $1,000

Allowance for Doubtful Accounts $1,000

A/R John Smith $1,000

Write-off of John Smiths Account (reduces/uses the ADA account)

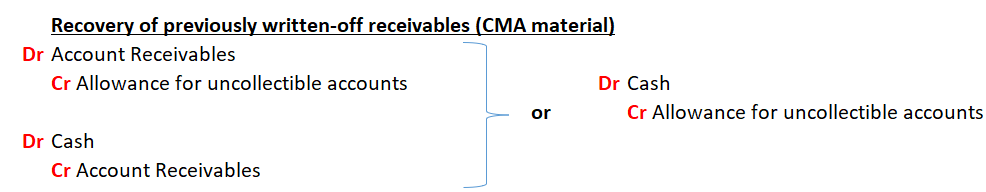

Now, John Smith pays the $1,000 and we reverse it. Two entries are used.

A/R John Smith $1,000

Allowance for Doubtful Accounts $1,000

Increase the ADA account as we didn't need to use the amount

Cash $1,000

A/R John Smith $1,000

John Smith paid his bill

I believe it would also be correct to do it in one entry. I don't like this method but the accounting should be the same.

Cash $1,000

Allowance for Doubtful Accounts $1,000

* A/R John Smith is still empty with this single entry and ADA is put back to it's correct spot.

In short, your first method is for estimating bad debt. Bad Debt Expense is only debit when establishing an estimate. It is not touched otherwise. The CMA information below is also correct as it deals with a customer not paying. Both of your examples are correct because they are different.------------------------------

Andrew Bernard

Illinois, United States

Part 1: 370

Part 2: 350 (almost!)

------------------------------

Original Message:

Sent: 12-23-2021 12:49 AM

From: Phuc Ngo Mai Thien

Subject: 1A Allowance for doubtfull debt

Hello everyone,

Could anyone please help me to resolve the following question:

How should I deal with the Allowance for doubtful accounts when its related Receivables is collected, under the percentage of Credit Sales method?

Under Percentage of Credit sales method, the credit loss expense is calculated as a percentage of total credit sales. Any previous balance in the allowance account or any previously recognized credit loss expense should be ignored

------------------------------

Phuc

Original Message:

Sent: 12-22-2021 04:02 AM

From: Phuc Ngo Mai Thien

Subject: 1A Allowance for doubtfull debt

Hello everyone,

I hope you are all well

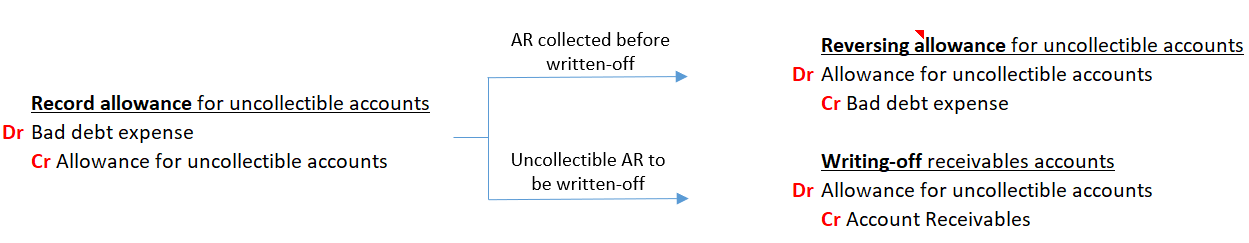

I coudn't find any source to tell me what to do with the Allowance for bad debt when the related Account Receivables is collected before the Allowance is written-off;

The following entries is how to deal with the situation that I learnt at school. Is it correct to apply in CMA?

This is how I found from CMA material to record the recoveries of previously written-off account (on the previous accounting period)

"The only impact that the allowance for doubtful accounts has on the income statement is the initial charge to bad debt expense when the allowance is initially funded. Any subsequent write-offs of accounts receivable against the allowance for doubtful accounts only impact the balance sheet." - Allowance for doubtful accounts definition - AccountingTools

"Bad debt expense is not affected when an account receivable is written-off or/and when an Account receivables which is previously written-off become collectible"

It means that once the allowance for doubtful debt is made, the Bad debt expense would not be reversed for any reason. The recovery of previously written-off account would not be adjusted for P&L statement. While the initial recognition of Allowance for doubtful debt has impacted the P&L. Did I miss something?

Thank you

------------------------------

Phuc

------------------------------