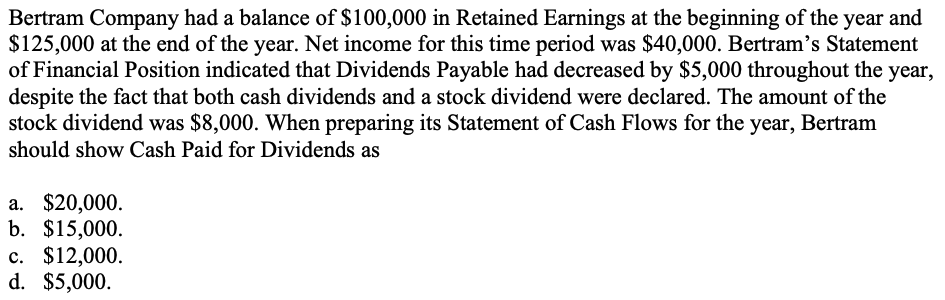

Please find below given calculation:

Total dividends declared to be calculated as follows:

Opening retained earnings........................................................ $100,000

Net income for the year.............................................................. 40,000

Closing retained earnings............................................................. (125,000)

Dividends declared during the year..............................................$ 15,000

Since $8,000 is the amount of stock dividends declared, the amount of cash dividends declared this year is $7,000 ($15,000 - $8,000).

The amount of cash dividends paid during the year can be calculated as follows:

Decrease in the cash dividends payable account during the period ...........$ 5,000

Cash dividends declared during the year................................................ 7,000

Cash paid for dividends during the year................................................ $12,000

Stock dividends declared does not affect the dividends payable account.

------------------------------

Dinesh Thazhathidam

Director/Manager

DUBAI

United Arab Emirates

------------------------------

Original Message:

Sent: 09-29-2021 06:48 PM

From: Sunhye Lee

Subject: CMA Part 1_Cash dividends

Hi All,

Could anyone explain why the answer of the following question is $12,000?

Upon the answer, the formula is as below, but i do not understand why $5,000 was added..

$100,000 + $40,000 - $8,000 + $5,000 – X

= $137,000 – X

X =$12,000

------------------------------

Sunhye Lee

Controller

Seoul

Korea, Republic of

------------------------------